What Brings Down Property Value? 7 Things to Address Now

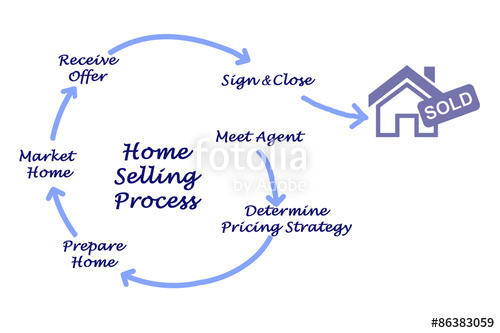

When diving into the real estate market, whether you’re selling your home in the bustling housing market of Northern Virginia or simply curious about your house’s property value, understanding what can diminish its worth is